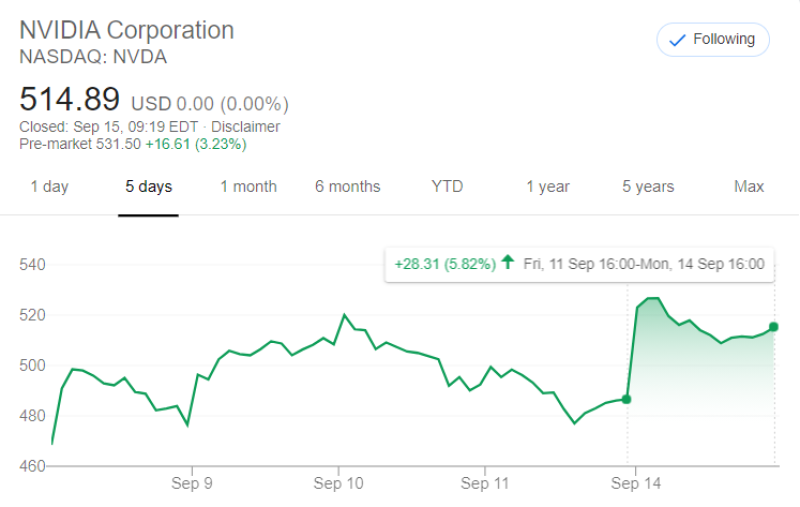

($)Īnalysts Expect Strong Performance In Line With NVIDIA's Own Guidance For Current QuarterĬiti analyst Atif Malik also set NVIDIA's price target at $540/share, marking for a roughly similar increase as Piper's from an earlier target of $392/share. At yesterday's call, the company revealed that it expects revenues to grow by 14% sequentially and 47% year-over-year to stand at roughly $4.4 billion. The firm's analyst Harsh Kumar based this decision not only on the strong performance that NVIDIA showed during its second-quarter but also on the company's forward guidance for the current quarter that will end in October. Piper hiked its NVIDIA price target to $540 from an earlier $390, marking for a 38% increase. The biggest price target increases however came from Piper Sandler and Citi Group. The results have led the research firm to further raise expectations for NVIDIA, with Oppenheimer's new price target for the company now standing at $550, following a 10% hike.Īnalyst Rick Schafer bases this hike on NVIDIA's strong performance during the quarter and on what he believes is an incoming "strong gaming" cycle - undoubtedly to be ushered in by the rumored RTX 30 'Ampere' lineup that is rumored to double Raytracing and DLSS performance over its predecessor. Heading into yesterday's earnings, Oppenheimer had raised its price target for NVIDIA by 25%, or from $400/share to $500/share. The drops came after Tuesday's rally reversed itself following statements by the Federal Reserve indicating that heavy impacts on the economy from the coronavirus were not over. NVIDIA's shares closed at $485 yesterday and dropped in pre-market hours today even as the company posted strong quarterly results. Out of the six analyst notes from Barclays, Oppenheimer, Mizuho, Citi, RBS and Piper Sandler released since NVIDIA's earnings report yesterday, Oppenheimer has the highest price target for the company.

NVIDIA Price Targets Raised Following Strong Performance & Strong Expectations For Upcoming Gaming Cycle

0 kommentar(er)

0 kommentar(er)